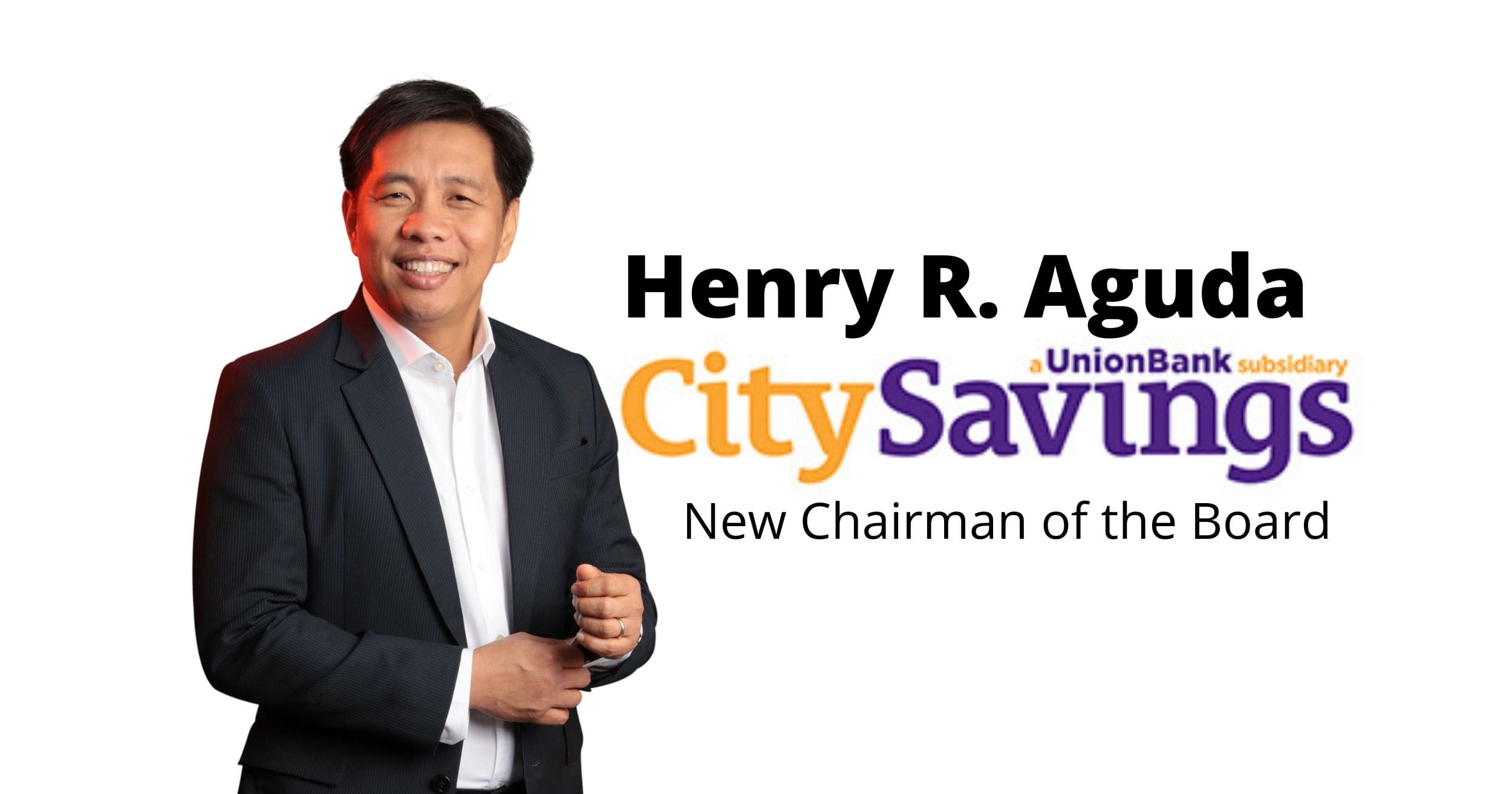

This comes alongside the appointment of UnionBank’s Chief Technology and Operations Officer and Chief Transformation Officer, Henry R. Aguda, as its new Chairman of the Board, whose expertise is expected to boost CitySavings’ digital transformation initiative.

“Henry brings a wealth of expertise that was also instrumental in UnionBank’s successful digital transformation. With his appointment as its new Chairman, we are confident that CitySavings will be able to go further in its transformation journey, allowing it to cater to the underserved segment much better,” said Larry Ocampo, CitySavings President, and CEO.

“CitySavings has been helping many of our kababayans through accessible financing options, and our priority is to bring these loans to even more potential customers by optimizing the Bank’s existing customer touchpoints and the infrastructures that support them, powered by artificial intelligence (AI) models created by our Data Science and AI Team,” Aguda said.

CitySavings has seen great results with its initial pilot of AI-driven solutions that utilized historical data to improve customer relevance for loans availment, achieving a conversion rate of 35 percent in its testing phase. CitySavings also created an in-house credit scoring model to complement its AI capabilities, which improved turnaround time and enabled the Bank to raise its motorcycle loans portfolio to P7.06 billion as of end-March. CitySavings’ stronger, AI-focused digital push is seen to magnify the success of these projects, allowing the Bank to serve even more customers.

With its primary goal of becoming the Philippines’ leading thrift bank, CitySavings sees digital transformation as a necessary step in achieving this goal. By utilizing emerging technologies as well as key learnings from its parent bank UnionBank, CitySavings hopes to shore up its digital capabilities, and in turn, create products and services that are more meaningful to Filipinos.

“This renewed commitment to digitally transforming our organization will allow us to harness innovation like never before and serve our customers better. We want the next motorcycle loan applicant to be able to get their new motorcycle within the same hour, or the next teacher to be able to enjoy the most flexible loan repayment plan possible,” said Ocampo. “CitySavings has always been one with UnionBank in envisioning a future where everyone is empowered by technology. This brand new chapter for us opens new possibilities toward achieving that vision.”